work opportunity tax credit questionnaire on job application

The tax credit amount under the WOTC program depends on employee retention. 6 hours agoMaryland Gov.

Work Opportunity Tax Credit What Is Wotc Adp

The Work Opportunity Tax Credit.

. I was under the impression that employers were not allowed to ask about age because it is a slippery slope to discriminating on the basis of age. Employers can still hire these individuals if they so choose but will not be able to claim the tax credit. Is it legal for a companies to require that you fill out a tax credit screening in order to complete a job application.

Thats why youll see job fairs targeting veterans or unemployed in IOWA or bumfuck nowhere Nebraska. Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC targeted group. A Federal Business Tax Credit for Iowas Employers About The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who hire eligible individuals from target groups with significant barriers to employment.

Questions and answers about the Work Opportunity Tax Credit Online eWOTC service. There are two sets of frequently asked questions for WOTC customers. WOTC Work Opportunity Tax Credit Questionnaire KS Staffing Solutions Inc.

This tax credit may give the employer the incentive to hire you for the job. Information about Form 8850 Pre-Screening Notice and Certification Request for the Work Opportunity Credit including recent updates related forms and instructions on how to file. Is participating in the WOTC program offered by the government.

The Work Opportunity Tax Credit is a voluntary program. Employers use Form 8850 to make a written request to their SWA to certify someone for the work opportunity credit. Companies hiring long-term unemployed workers receive a tax credit of 35 percent of the first 6000 per new hire employee earned in monthly wages during the first year of employment.

As such employers are not obligated to recruit WOTC-eligible applicants and job applicants dont have to complete the WOTC eligibility questionnaire. A couple of jobs I have applied for have required me to complete the Work Opportunity Tax Credit as part of my application process. Work Opportunity Tax Credit WOTC Frequently Asked Questions.

This tax credit is for a period of six months but it can be for up to 40 percent if the employer conducts job training. The main objective of this program is to enable the targeted employees to gradually move from economic dependency into self-sufficiency as they. The Missouri Work Opportunity Tax Credit WOTC Program offers an online application system for a more efficient means of submitting applications for certification.

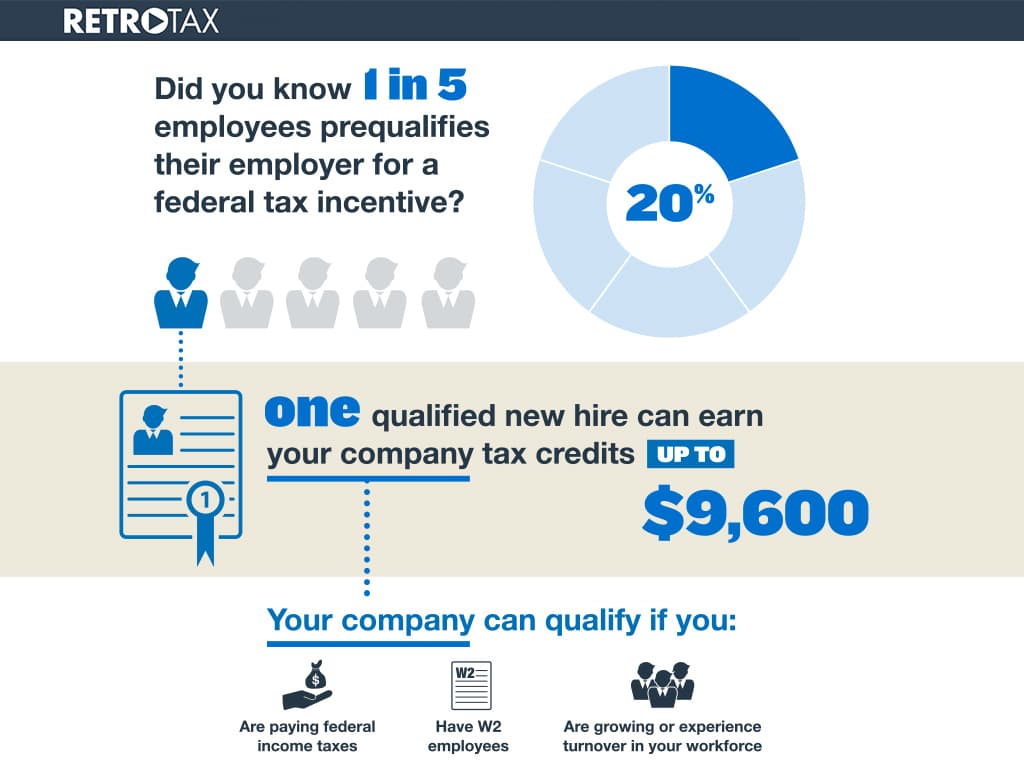

Larry Hogan and leaders in the legislature have reached a 186 billion agreement for tax relief over five years for retirees small businesses and low-income families officials. The very first question is Are you under age 40 How is this legal. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment.

Completing Your WOTC Questionnaire. Work Opportunity Tax Credit questionnaire Page one of Form 8850 is the WOTC questionnaire. Employers must apply for and receive a certification verifying the new hire is a.

Below you will find the steps to complete the WOTC both ways. The application entry process includes entering employee and employer information from the completed and signed IRS Form 8850 and ETA Form 9061. Work Opportunity Tax Credit Questionnaire Employers receive substantial tax credits for hiring certain applicants under the Work Opportunity Tax Credit or WOTC a program created by the US.

Each year across the United States employers claim more than 1 billion in tax credits under the WOTC program. The credit to for-profit employers is 25 of qualified first-year wages for those employed at least 120 hours but fewer than 400 hours and 40 for those employed 400 hours or more. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef.

Below you will find the steps to complete the WOTC both ways. If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow. If you are in one of the target groups listed below an employer who hires you could receive a federal tax credit of up to 9600.

Ive been searching for employment for some time and have came across companies asking me to fill out a tax screening form because the employer participates in the work opportunity tax program. The Work Opportunity Tax Credit WOTC is a Federal tax credit incentive that Congress provides to employers for hiring individuals from certain target groups who have consistently faced barriers to employment. For most target groups WOTC is based on qualified wages paid to the employee for the first year of employment.

Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. The program has been designed to promote the hiring of individuals who qualify as a member of a target group and to provide a Federal Tax Credit to employers who hire these individuals. Questions and answers about the Work Opportunity Tax Credit program.

However some companies go on mass hiring sprees targeting certain populations under these survey to take advantage of the tax credits. Completing Your WOTC Questionnaire. If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow.

WOTC Improve Your Chances of Being Hired. It asks the applicant about any military service participation in government assistance programs recent unemployment and other targeted questions. The Work Opportunity Tax Credit WOTC can help you get a job.

While they cant say ONLY certain demographics may apply they target tax-advantagous audiences. How the Tax Credit Surveys are Used.

With Wotc Timing Is Everything Wotc Planet

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Work Opportunity Tax Credits Wotc Walton

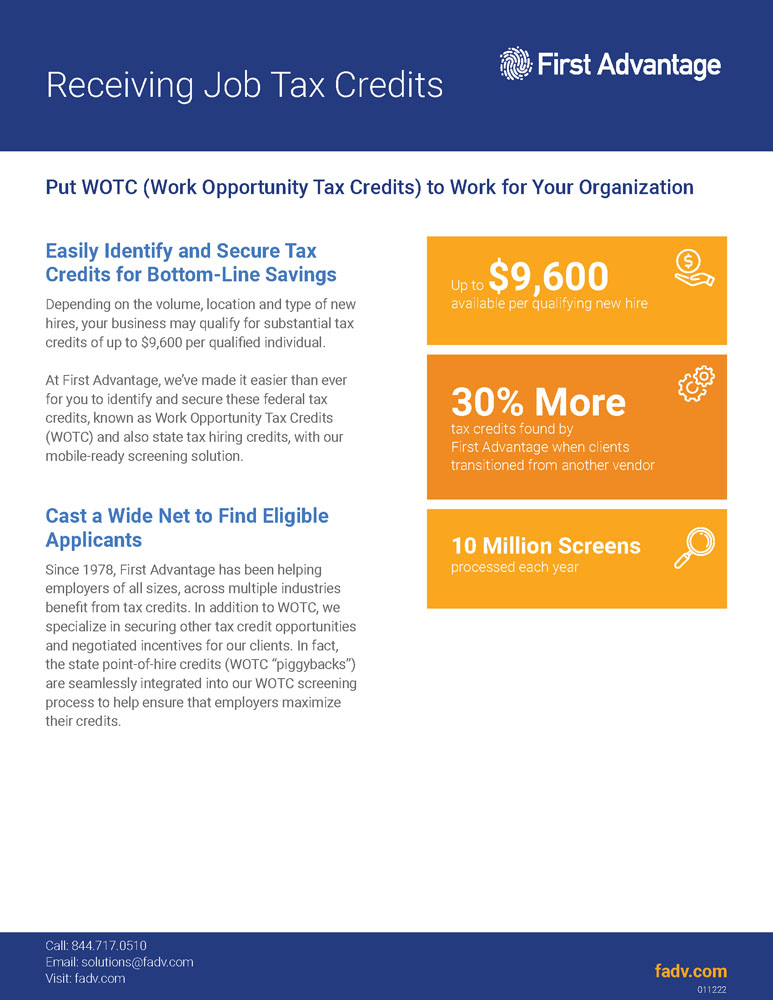

Work Opportunity Tax Credit First Advantage

What Is Tax Credit Screening On Job Application

Work Opportunity Tax Credit What Is Wotc Adp

Adp Work Opportunity Tax Credit Wotc Integration For Icims By Adp Icims Marketplace

Retrotax Tax Credit Administration Jazzhr Marketplace

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

Retrotax Tax Credit Administration Jazzhr Marketplace

Work Opportunity Tax Credit What Is Wotc Adp

Get And Sign Wotc Questionnaire 2012 2022 Form

Work Opportunity Tax Credit What Is Wotc Adp

Completing Your Wotc Questionnaire

Adp Work Opportunity Tax Credit Wotc Integration For Icims By Adp Icims Marketplace